- Análisis

- Análisis Técnico

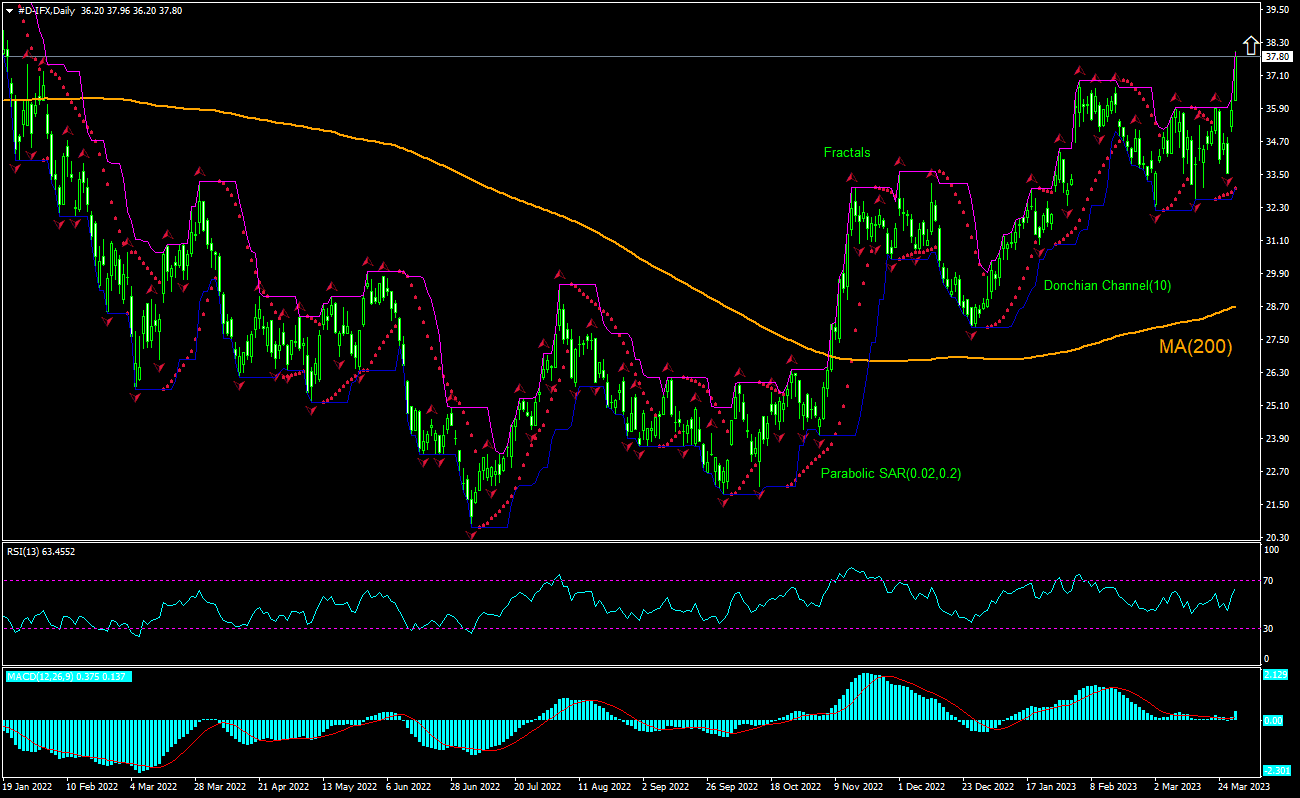

Infineon Technologies AG Análisis Técnico - Infineon Technologies AG Trading: 2023-03-31

Infineon Technologies AG Resumen de análisis técnico

Por encima de 37.96

Buy Stop

Por debajo de 33.52

Stop Loss

| Indicador | Señal |

| RSI | Neutral |

| MACD | Comprar |

| Donchian Channel | Comprar |

| MA(200) | Comprar |

| Fractals | Comprar |

| Parabolic SAR | Comprar |

Infineon Technologies AG Análisis gráfico

Infineon Technologies AG Análisis técnico

The technical analysis of the Infineon stock price chart on daily timeframe shows #D-IFX, Daily hit 13-month high yesterday above the 200-day moving average MA(200) which is rising. We believe the bullish momentum will resume after the price breaches above the upper boundary of Donchian channel at 37.96. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 33.52. After placing the order, the stop loss is to be moved every day to the next fractal low indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (33.52) without reaching the order (37.96), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Análisis fundamental de Acciones - Infineon Technologies AG

Infineon stock rallied after the chip maker raised its forecasts. Will the Infineon stock price continue advancing?

Infineon is a German corporation engaged in the design, development, manufacturing and marketing of semiconductor systems worldwide. Its market capitalization is €44.5 billion. The stock is trading at P/E ratio (Trailing Twelve Months) of 19.4 currently and at Forward P/E ratio of 15.95. The chipmaker earned a Revenue (ttm) of €15.01 billion, Return on Assets (ttm) of 8.51% and Return on Equity (ttm) of 18.19%. Infineon shares closed 6.3% higher on the day on Wednesday after the company raised its outlook for both its financial second quarter and the year 2023. Second quarter sales, which will be released on May 4, are now forecast above €4 billion, compared with around €3.9 billion previously. The chipmaker said it now expects 2023 sales significantly above the €15.5 billion forecast previously, up from €14.2 billion last year. It noted there would be a corresponding positive impact on margins, citing strong demand for products in automotive and industrials divisions as carmakers and data centers are restocking inventories following a global chip glut, leading to higher prices.

Nota:

Este resumen tiene carácter informativo-educativo y se publica de forma gratuita. Todos los datos que contiene este resumen, son obtenidos de fuentes públicas que se consideran más o menos fiables. Además, no hay niguna garantía de que la información sea completa y exacta. En el futuro, los resúmenes no se actualizarán. Toda la información en cada resumen, incluyendo las opiniones, indicadores, gráficos y todo lo demás, se proporciona sólo para la observación y no se considera como un consejo o una recomendación financiera. Todo el texto y cualquier parte suya, así como los gráficos no pueden considerarse como una oferta para realizar alguna transacción con cualquier activo. La compañía IFC Markets y sus empleados en cualquier circunstancia no son responsables de ninguna acción tomada por otra persona durante o después de la observación del resumen.